Net pay calculator indiana

Heres how it works. Use this federal gross pay calculator to gross up wages based on net pay.

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

To minimize the amount of interest paid increase the amount of your down payment and increase your monthly payments when possible.

. Switch to Indiana hourly calculator. An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department. Your average tax rate is 169 and your marginal tax rate is 301This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Payroll runs the employees last paycheck using the old pay rate to calculate earnings.

Pay on a specified day once a month. Pay on specified dates twice a month usually on the fifteenth and thirtieth. This will allow you to claim more deductions in the current tax year essentially borrowing from next years write-offs.

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator. Based on the information provided in the net price calculator the following represents an estimate of net price of attendance at Oakland University. Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2022 tax year on Aug 02 2022.

The Loan Savings Calculator shows how FICO scores impact the interest you pay on a loan. Interest Rate This is the rate at which you will have to pay back additional funds for the use of money lent to you. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

2022 state and local income tax rates. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Taxes can be divided into two annual installments with one being due on May 10 and the other on November 10.

Interest Rates are calculated based off of borrowers credit scores and the amount of money being lent. Real estate owners in the state of Indiana must pay taxes on their property every year. Cost of attendance financial assistance availability and awarding criteria change every year.

For example if your business rent is due January 5th pay it December 30th. Interest Rates as of 9162022. Payroll check calculator is updated for payroll year 2022 and new W4.

Pay 4 times a year. Pay every other week generally on the same day each pay period. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Ohio Paycheck Calculator Calculate your take home pay after federal Ohio taxes Updated for 2022 tax year on Aug 02 2022. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise. Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate.

You can see that working to get your score in the higher ranges can mean a big savings. Rather than waiting till January to pay your regularly scheduled bills pay them in December instead. As in most other states the Indiana property tax is ad valorem meaning its based on the value of property.

It is NOT a financial assistance offer. Pay each week generally on the same day each pay period. Select your loan type and state enter the appropriate loan details and choose your current FICO score range.

If you make 55000 a year living in the region of Washington USA you will be taxed 9317That means that your net pay will be 45683 per year or 3807 per month. Name State Territory Category PolicyIncentive Type Created Last Updated. Send us a message.

Net Price Calculator Results. How Property Taxes Work in Indiana. Pay 2 times a year.

Calculate your take home pay after taxes.

The State Of The State Illinois Wall Of Shame Infographic Business Jobs Education

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

How To Qualify For The Indiana Choice Scholarship Program July 30 2021

Indiana Paycheck Calculator Adp

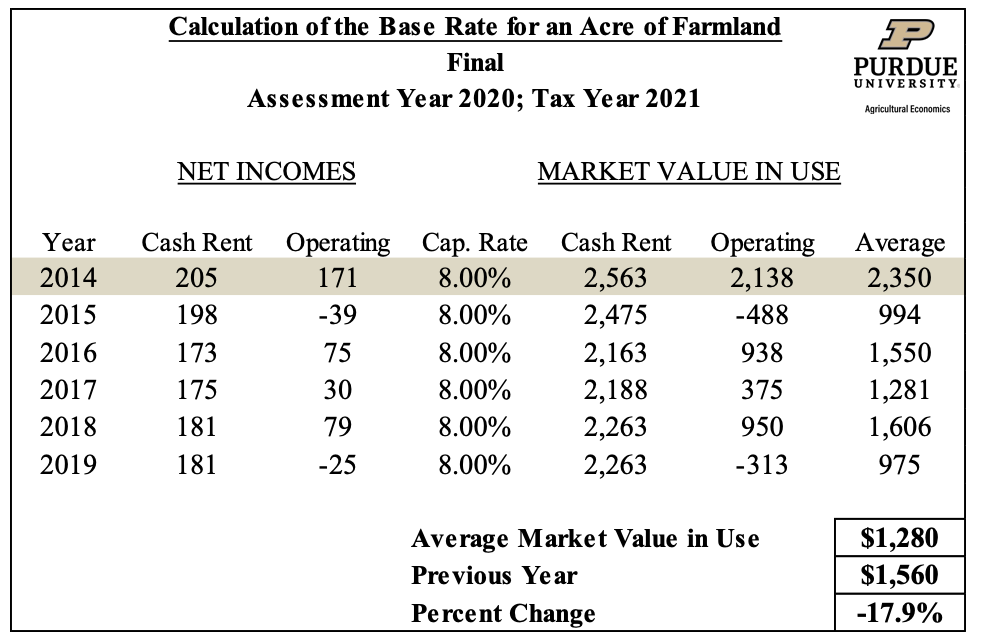

Farmland Assessments Tax Bills Purdue Agricultural Economics

Essay Info Fafsa Essay Student

Indiana Paycheck Calculator Smartasset

Marginal Tax Rate Calculator Indiana Members Credit Union

Indiana Paycheck Calculator Smartasset

2

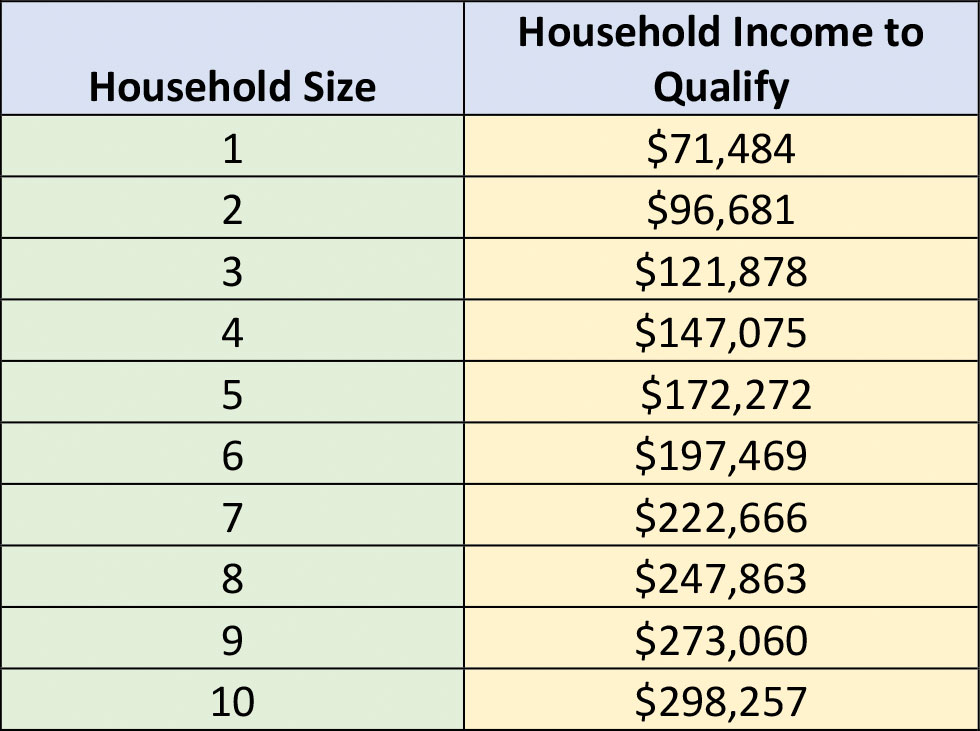

Hip Income Requirements Mdwise Inc

2022 Best Places To Live In Indiana Niche

Moving From Indiana To Florida Benefits Cost How To

Indiana Paycheck Calculator Adp

Indiana Map Map Of Indiana Indiana Maps Collection Indiana Map Time Zone Map Map

Indiana Income Tax Calculator Smartasset

Indiana Teacherpensions Org